By Michael Woyton

It was a squeaker, with an outcome not certain until the last vote was tallied, but the GOPmagas approved their budget blueprint Tuesday night.

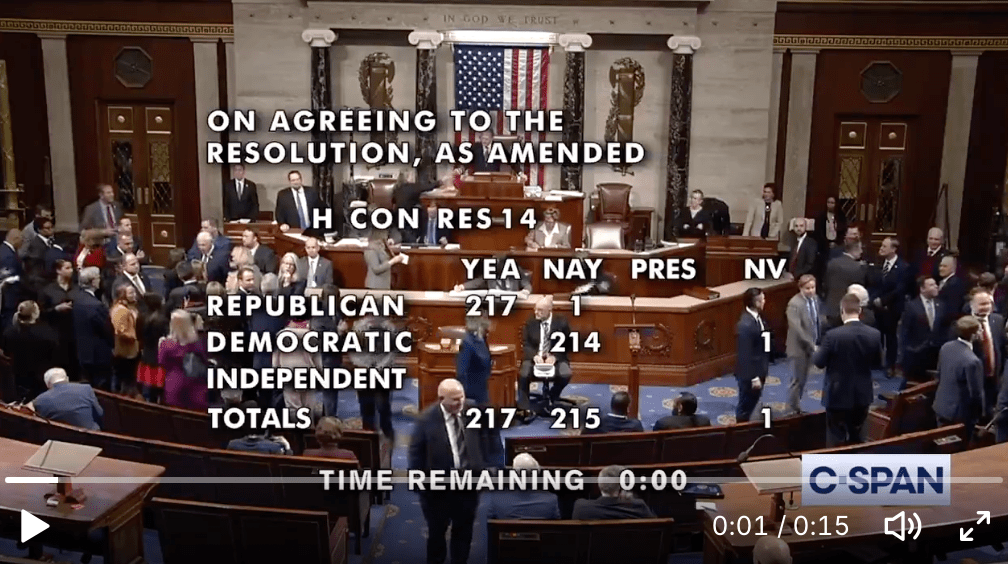

The final vote was 217 Republicans approving the spending package and 215 Democrats and one Republican voting in opposition, according to the Associated Press.

What was approved was $4.5 trillion in tax breaks and $2 trillion in spending cuts.

But it’s not law yet.

Subscribe to On Second Thought for free:

“Next steps are long and cumbersome before anything can become law — weeks of committee hearings to draft the details and send the House version to the Senate, where Republicans passed their own scaled-back version,” the AP said. “And more big votes are ahead, including an unrelated deal to prevent a government shutdown when federal funding expires March 14. Those talks are also underway.”

Good times indeed.

While this was an early test for the felon-in-chief’s agenda, it’s now up to the House Republicans to craft a bill “for an ambitious, partisan budget plan,” NPR reported.

The vote was also “a critical step to laying out a budget blueprint, allowing Republicans to unlock reconciliation letting the GOP avoid a Democratic filibuster,” NPR said.

It is likely to be a real slog getting there because the blueprint is asking for $2 trillion in cuts — “the exact details of those cuts will be sorted out later, by individual committees in the House.”

One committee — the House Energy and Commerce Committee — is going to be responsible for coming up with a savings of $880 billion. Energy and Commerce oversees spending for Medicare and Medicaid, so it’s likely those committee members are not going to look too far afield for things to slice and dice.

And then there’s Kentucky Rep. Thomas Massie who was the lone Republican “no” vote. He posted on social media, “If the Republican budget passes, the deficit gets worse, not better.”

“The GOP budget extends the 5 yr. tax holiday we’ve been enjoying,” he posted on the site formerly known as Twitter, “but because it doesn’t cut spending much, it increases the deficit by over $300 billion/yr. compared to letting tax cuts expire. Over 10 years, this budget will add $20 trillion to US debt.”

Setting aside Massie’s “tax holiday we’ve been enjoying” — have you seen a decrease in taxes? — the budget blueprint is not draconian enough for the Kentucky congressman.

Since Congress will have to buckle down in order to produce a tax package that both the House and Senate can OK, now is the time to let your representatives know what you think of it.

It is more important than ever to let your representative — especially on the GOP side of the aisle — know your thoughts about the proposed cuts.

The House Budget Committee Democratic Caucus has a website on which the public can see how the upcoming budget will likely affect them.

You can search by congressional district, if you happen to know it, or by your rep’s name, your address/ZIP or location.

I did a search for my hometown of Odessa, Texas, to see how that solidly red district would fare under the Republicans’ spending plan.

Republican Rep. August Pfluger has represented the TX-11th district since 2021. He will be running for re-election in 2026. The district stretches from Odessa to Killeen and includes the cities of Midland and San Angelo. Pfluger also serves on the House Energy and Commerce Committee, so he will be intimately involved in making the budget cuts.

The Democratic caucus’ website said, if the budget is passed, there will be an average annual tax cut of $324,266 for the richest 0.1 percent, and $2 trillion will be given away to CEOs and big corporations.

“Under the Republican budget plan, the 90,000 people who receive coverage under the Affordable Care Act in Rep. August Pfluger’s district would see their average premium go up by $430 per year — a 90% increase,” the website said.

A 60-year-old couple with a household income of $85,000 in Pfluger’s district would see health insurance costs increase by $15,493 per year — or a 214 percent increase.

There are also more than 104,000 people on Medicaid in the TX-11th congressional district who will be at risk of losing their health care under the GOP budget. That includes 77,268 children under the age of 19 and 15,000 seniors over 65.

Food assistance programs, such as the Supplemental Nutrition Assistance Program, will be threatened under the GOP budget and will affect 96,000 people in Pfluger’s district.

Above and beyond the budget, there are 14,832 people in Pfluger’s district alone that the federal government employs. Their livelihoods and the district’s economy are being threatened by the job eliminations under President Musk.

The TX-11th is not an outlier. Even a super wealthy district such as the NY-16th, newly led by Rep. George Latimer, would be hit hard by the GOP budget plan. The NY-16th contains White Plains, Rye, Larchmont, Scarsdale and New Rochelle.

Average premiums for the ACA would go up by almost $2,900 a year for 10,000 recipients, and that 60-year-old couple would see a 105 percent increase in health insurance premiums — or almost $7,600 per year.

Now is the time to let your Congress members know that the vast majority of Americans cannot afford to give the super wealthy more tax breaks.

Find and follow me on BlueSky through this link.

Lead art: Screen grab from C-Span